Spring cleaning your finances might be the last thing on your mind. After all it’s been a turbulent few years. A worldwide pandemic locked down businesses, forced remote workspaces, and spurred the great recession. Just as things seem to move toward the “new normal”, Russia invades Ukraine, and the world is once more on edge.…

Especially in the wake of a worldwide pandemic, such as COVID-19, there are life events that change everything. Americore advises clients on preparing for all types of life events. But During tax season, the IRS publishes which of those life events it recognizes, and the implications of that recognition. Each life event might require action…

Businesses are still evolving to meet demands of the new normal, but with lower sales dollars, it’s harder than it used to be. Moreover, the great resignation is heightening the struggle for many small to mid-sized businesses. One of the solutions to lost income and concerns over employee retention is still available. Government programs are…

You hear it over and over; we have supply chain issues and may not have your item when you expected it. New automobiles are in short supply and the prices of used cars are up 30 percent. A gun cleaning supplier recently noted that they overbought early to avoid the crunch, but a smaller scale…

2021 is about to close. All the tax planning changes that could be made for the 2021 tax year have been made. It’s time to celebrate ringing in a new year. Hopefully, the new year will have less viral variants than the last one. Meanwhile, wishing you better 2022 planning and a Happy new year!…

While I love holiday celebrations as much as the next person, excessive tax liabilities will outlast the toasts, hors d’oeuvres and twinkling lights.

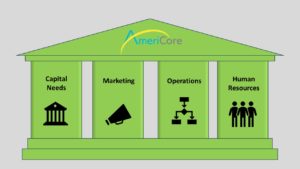

Americore Blue Apple financial solutions can help you solve the financial bottlenecks that are holding you back …

In this third and final installment of finance 101, we will review public finance. Public finance, also known as Government Finance, oversees taxing, governmental spending, budgeting, and debt-issuance policies that affect how a government pays for the services it provides to the public. Public Revenue sources By overseeing the distribution of resources, income and economic stability,…

Corporate Finance is oversight of a corporation’s money, from planning to organization and management, as well as investment.

Just for fun, we thought we’d review some basics of Personal Finance 101, as students head back to the classrooms.