Posts by Jo Gardner

Americore Delivers Value to Business Advisors

It happens no matter how many expert business advisors you have working for you, or how talented they are. Unless programs that deliver more cash to your organization falls in their specific area of expertise, they could miss them. Dennis Bays built his career mending that gap, and he does it while working with your…

Read MoreDennis Bays and the Story of Americore

Dennis Bays, CEO of Americore is excited about the number of opportunities available to improve the cash flow and profitability for the business community. Whether you are looking to reduce tax liabilities, find working capital for small or midsize businesses, planning for retirement or other wealth building vehicles, Americore has access to a unique solution…

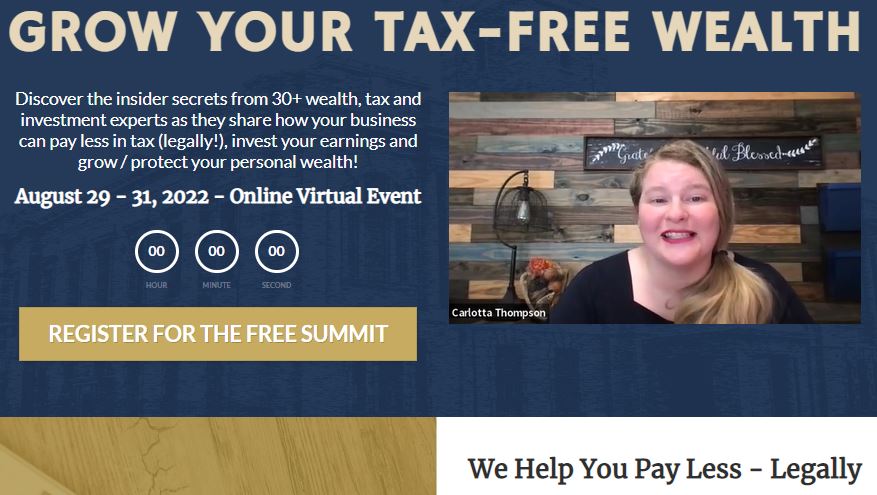

Read MoreAre You at the Tax Savings Summit for Business Owners?

Are you already at the 2022 Tax Savings Summit virtual conference? If not, why not? It’s free. It’s informative and it could save you money. Besides Dennis Bays, there are around thirty other financial professionals and tax strategists. What The Tax Savings Summit Is Host Carlotta Thompson founded Tax Strategists of America. Though Carlotta Thompson…

Read MoreTax Savings Summit 2022 – A Must Attend Event

Small US Business Owners, Are you paying too much in taxes? If you’re a US Business Owner, you need to attend this Tax Savings Summit. It will reveal industry experts’ secrets for reducing tax bills and it’s just around the corner. The virtual tax savings summit doors open on August 29. Over a three day…

Read MoreDefensive Investments in a Bear Market

There was “good news” on the economy, even as the federal reserve announced the next rate hike. Wednesday, July 27, Federal Reserve Chairman Jerome Powell said “I do not think the U.S. is currently in a recession and the reason is there are too many areas of the economy that are performing too well.” So,…

Read MoreIt’s Mid-Summer – Time for a Financial Checkup

We’re more than halfway through the year, and if you haven’t already done so, now is a great time to review your progress on financial goals for 2022. Checking on your progress to your saving, business, and retirement goals now gives you time to adjust your approach if needed. No worries: we’ve got a few…

Read MoreAmericore, Your Financial Advisor for Business

The value of money is in the extra enjoyment and comfort that it adds to daily living. Having enough to not worry about money, allows you to live your life to the fullest and fulfill your ambitions. How you can reach that point is something Dennis Bays at Americore want to discuss with you. Dennis…

Read MoreBlue Apple’s Meaning

We frequently talk about our Blue Apple Solutions and each time someone inevitably asks us about Blue Apple’s Meaning. Well, we’re glad the question was asked, and we’ll try to explain the reference better. An Apple by Any Other Color Apples come in many colors. You can find bright red apples, pink-red, purple-red, golden yellow,…

Read MoreEnhance Your Team With A Trusted Advisor at Americore

Someone once told me “anything worth doing is worth doing badly.” What he meant was that you should at least try to do something, even if it means failing at it. In certain areas, I disagree. When it comes to financial decisions, anything worth doing should be done well. If you are qualified, great!. If…

Read MoreEarth Day Investing in Sustainability

Earth Day 2022 is a fitting time to consider sustainability in business. There are resources and programs already available and you can benefit from them while going green. Your clients would love it and green living equals tax savings. In a recent Deloitte publication, a few reminders came out that can add to those savings…

Read More