Personal Finance 101- The Basics

Just for fun, we thought we’d review some basics of Personal Finance 101, as students head back to the classrooms. Finance, according to Investopedia is defined as activities associated with banking, debt, credit, capital markets, money and investments. In short, finance is getting and managing money.

Everyone needs money to operate, whether on a personal, corporate, or government level. Perhaps that is why finance is divided into these three subcategories. This Finance 101 article covers the basics of personal finance. Our next article will follow up on Corporate finance.

Personal Finance

The term personal finance refers to managing your own money, including earning, investing and saving it. In our personal finance 101 money management, we’ll cover general budgeting, banking, mortgages, investments, tax planning and retirement planning.

Budgeting

Maybe you are comfortable with your cash flow. Maybe you are using the same budget you set up years ago. It is just possible, that with a closer look you could find ways your money could work smarter for you. Regardless of your income level and whether you love or hate budgets, they are beneficial. Budgets reveal the true picture of where you stand…and where you could be. You need this knowledge to set goals to get to that place. If you are new to budgeting, using a worksheet simplifies the math. Microsoft office offers its subscribers a customizable free budget worksheet or you can search for an app to help you plan your money.

Once you see where your funds are going, figure out your financial goals. Decide how much you can put into savings, or investments or retirement planning to reach those goals. This is a good opportunity to re-evaluate how you use the money you have. When you are unsure of how to make money decisions, it’s time to speak with a financial advisor. Americore professionals know money and can provide tools for better decision making.

Personal Banking

Once, banks were a good way to protect the money you were saving. Today, banks handle a lot of different types of transactions. That is good, since transactions are becoming more electronic in nature. It the simplest of banking transactions, money needs to be moved into a bank account for you to make electronic payments out of that account. After you made your budget, you can look it over to see how most of your money is placed. Compare bank services and pricing to figure out which bank offers the best bang for your buck. ( Note: Make sure those fees are in your budget.)

Mortgages

Interest paid on a mortgage is low compared to the interest rate on other credit. Not only is the cost of funds low, but it is also tax deductible. It makes sense to buy a residence instead of renting it, so you can enjoy those potential savings. With that said, mortgages have gotten some homeowners into financial difficulty.

Here are some thoughts to keep in mind. Budget your entire PITIA mortgage payments, (principal, interest, taxes, hazard & mortgage Insurance, and association dues) based on your lowest expected gross monthly income. Even if your taxes and insurance are not escrowed, budget for it. You have to pay it anyway, so bank it until it is due.

If you qualify for a mortgage based on overtime income, you might be in a tight position without that overtime. Review your budget. Generally, mortgage underwriters prefer monthly housing payments that don’t go over 38% of your gross monthly income. If more of your money is committed elsewhere, you may want to reduce your budgeted monthly housing payment even more.

Personal Investments

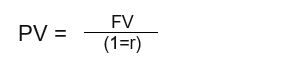

Commonly held principle: The value of non-invested money erodes over time. While others are earning different returns on their money, your money socked away in your mattress is losing the value it could have accumulated. It will also have less buying power when you retrieve it due to inflation. This is so fundamental that there is a formula for the value of money over time. If PV is present value, FV is future value and r is rate of interest, the formula is as follows:

If you are interested in making more investments on your own but not sure how you want to proceed, get investment advice here.

Tax Planning

You plan to pay taxes. Hey, that’s a great tax planning strategy, but we would like to get a little more specific here. How much taxes you pay and when can vary by an incredible amount, based on the knowledge of your advisor, your communication with them, and how well your advisement team works to strategize. Nearly every financial decision you make has tax consequences, from buying a toy to the investments you make. Planning ahead can save you money and sometimes make that money available much sooner than you expected. Americore knows Blue Apple tax savings programs designed for businesses like yours. Contact us or call today to learn how we can work with your team to enhance your savings.

Retirement Planning

Are you ready to retire today? If you can’t answer in the affirmative, you could benefit from a conversation with an Americore professional. Maybe you were set until your accounts took a hit during the great recession. Whether you prepared and had a setback, or failed to prepare enough, retirement doesn’t take care of itself. To save enough for the retirement you want, you need to make a plan. If you are over 40, you may already need to invest more while you are still working to fund your long term plan. You may also need to consider ways to invest smarter.

All of these topics are part of our personal finance 101. The key takeaway here, is planning. Not everyone is comfortable with charts and numbers. Americore works with a wide range of clientele. Some want personal financial guidance, and some look for corporate financial assistance. Getting the help you need is as easy as opening the conversation with your Americore Financial advisor. You’ll be glad you did.